Fraud Suite Network

Leverage live fraud detection to verify identities, reduce exposure,

and protect your customers from the downstream impact of fraud.

Fraud is Subtle, Damage Isn’t

Credit fraud is no longer a rarity — it’s a persistent threat often hiding in plain sight. With increasingly sophisticated tactics, bad actors exploit gaps in manual review processes with fake identities and unverified banking data. Absent proper safeguards, fraud slips through unnoticed, slowing down operations, increasing exposure, and putting both trust and reputation at risk.

72 Hour

Fraud Window

40%

Of Fraud Uses Synthetic Data

$190,000

Average Loss

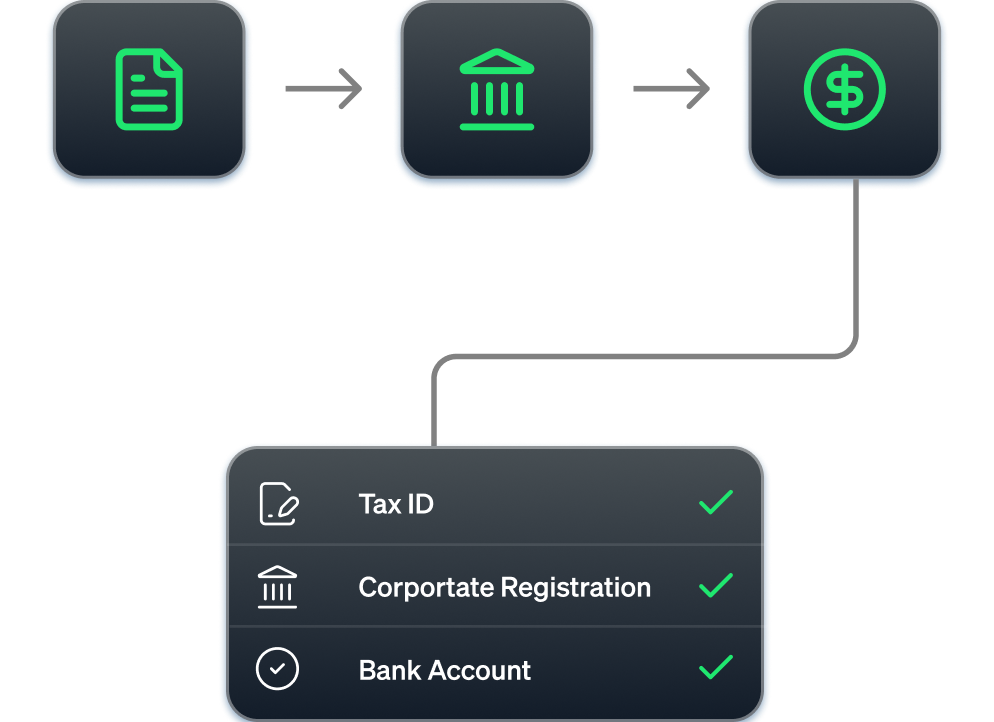

Go beyond validating Tax IDs, corporate registration, and bank account ownership. Leverage an integrated Fraud Suite Network and weave fraud detection into a single, automated workflow for deep analysis.

With trusted data sources like Plaid and Secretary of State registries built into the application process, you can surface verification results instantly. Rather than stopping at identity checks, the suite operationalizes them, ensuring your team gets answers without breaking stride.

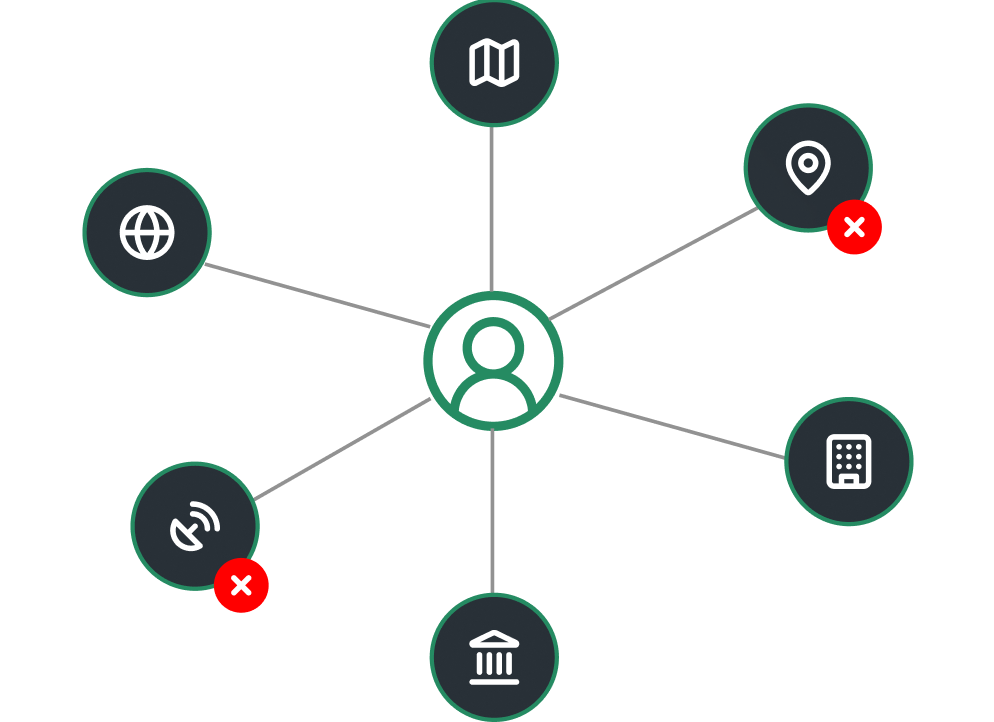

Once the basics are verified, the Fraud Suite applies advanced pattern recognition to detect synthetic identities, suspicious behavioral trends, and mismatched personal or business information. Using a blend of industry-leading identity verification and fraud detection technologies, it analyzes application data instantly, flagging potential fraud before it ever touches your pipeline.

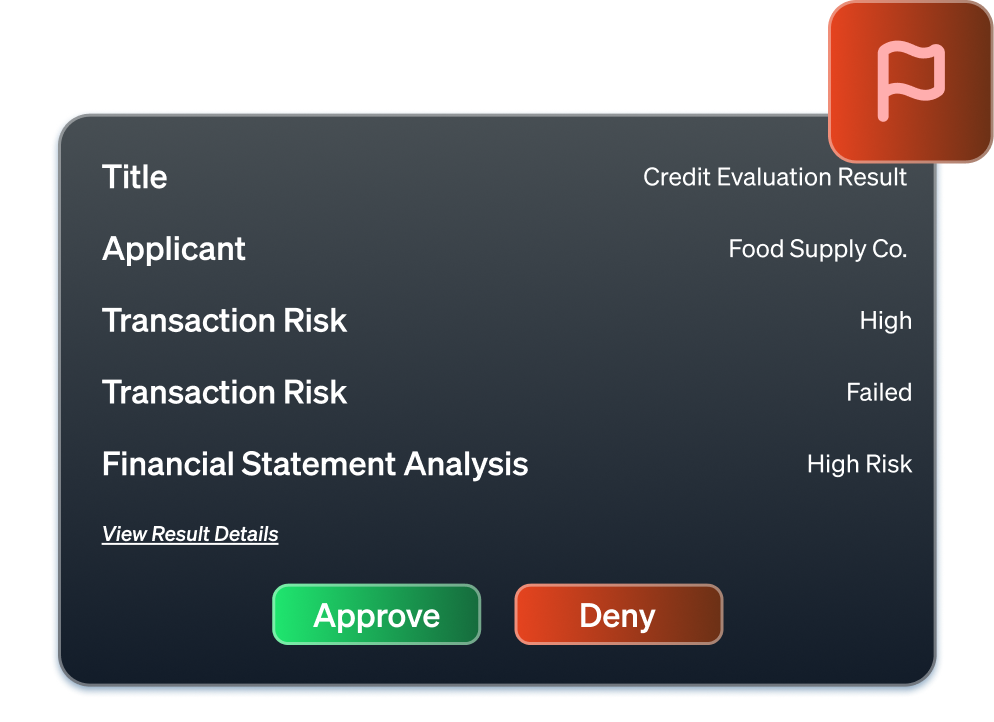

Speed and security should never have to compete. Utilizing custom scoring and anomaly detection, the Fraud Suite enables a fully automated approval process — instantly auto-approving low-risk applications while routing flagged cases for review. This built-in intelligence ensures safer, expedited onboarding without compromising on fraud protection.

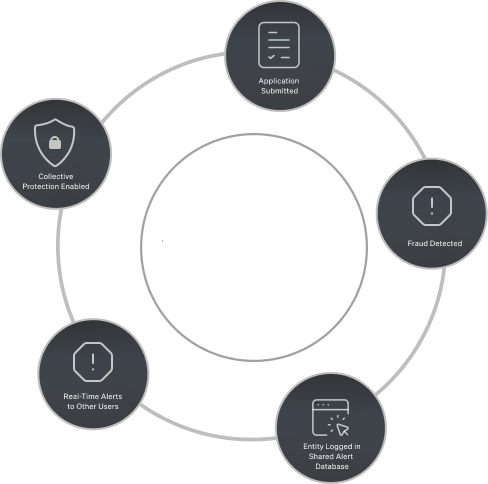

When an applicant or company is flagged for potential fraud, their information is added to a shared alert database within the platform. This means all users are immediately notified if the same entity attempts to apply for credit elsewhere — providing an additional layer of protection through collective vigilance.

Learn More About the Network.