Instant Decision Manager

Streamline routine credit approvals with real-time data and automation.

Automate with Precision

By leveraging full portfolio visibility, flexible review modules, and rule-based automation,

your team can move quickly while maintaining alignment within your credit policy.

Strategic Efficiency

Full portfolio visibility, flexible review workflows, and rule-based automation provides your team the tools to make credit decisions efficiently and confidently.

Custom Analysis and Decisioning

Set up custom models for customers with different terms, segments, or sizes. Adopt different levels of approval automation based on your credit management process

Real-Time Data Collection

Seamlessly pull credit data from bureaus, trade references, and internal systems at the moment an application is submitted.

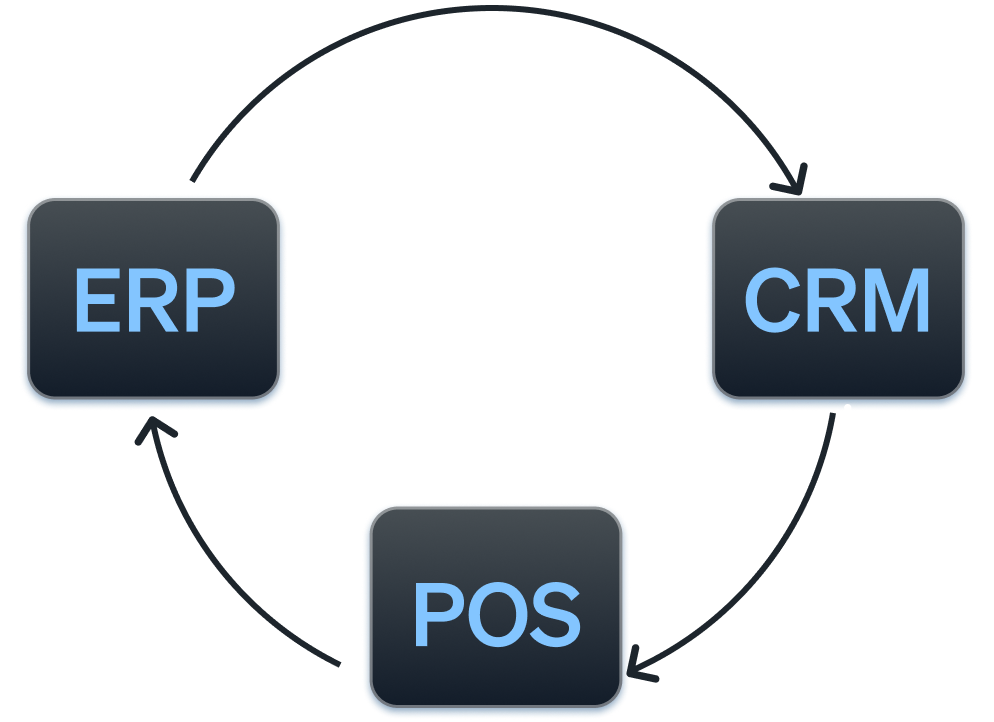

Seamless Integration

Connect IDM with your CRM, ERP, and other systems for real-time or scheduled data exchange, ensuring your credit decisions are always based on the latest information.

Delayed credit decisions often stall sales and frustrate customers. With IDM, automate the collection of data from multiple trusted sources at the moment of submission, so sales teams and customers alike can proceed unencumbered.

All the gathered data is instantly evaluated using your own configurable scoring models and approval criteria — delivering a risk-optimized decision within seconds.

By automating high-volume, low-risk credit decisions, IDM frees your team from routine approvals and repetitive tasks by over 90%. That means your credit managers can focus their expertise on complex, high-value accounts that require deeper analysis and discernment.

IDM connects with your existing systems — CRM, ERP, and more — to ensure every decision is driven by the most current, reliable data.

Through instant and scheduled data syncs, your team gets a complete, up-to-date view of every account. But it doesn’t stop at approvals — IDM also automates credit reviews and flags shifts in behavior, so you can act early, reduce risk, and keep cash flow steady without disrupting the customer experience.

Decisions at the Speed of Business

Custom rules, instant data, and proactive alerts combine to deliver accurate credit decisions in seconds.

Automated Credit Decisions

Instantly approve routine applications based on your custom criteria, eliminating the need for any manual effort.

Configurable Scoring Models

Establish decision logic and risk criteria to fit your unique policies and business goals.

Real-Time Data Integration

Pull credit data automatically from bureaus, trade references, and internal systems the moment applications arrive.

Proactive Risk Alerts

Receive automated notifications when risk indicators change, helping you act before problems arise.

Comprehensive Reporting

Access detailed, exportable reports to monitor credit activity and refine your strategies.

Explore AI tools behind faster processes, sharper insights, and better

outcomes – across credit, collections, and accounts receivables.